Give and Take: What AB inBev and SABMiller Must Do to Appease Regulators

- Annie Chen

- Dec 9, 2015

- 2 min read

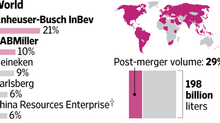

The acquisition of SABMiller by AB inBev, the third largest mergers and acquisitions case in history, is now under scrutiny by regulators around the world. Holding the two highest market shares in the global beer market, AB inBev’s $108 billion dollar acquisition of SABMiller will create many hurdles for the two companies. Antitrust laws prevent the merger from succeeding, as AB inBev and SABMiller hold about 30% of the world’s beer and 75% in the USA, which will require the two companies to make concessions, sacrificing much of their brands and market shares.

Antitrust laws aim to protect the consumers, which is important as large mergers such as AB inBev and SABMiller may lower competition, while creating more monopolistic behavior. The merger may increase prices while lowering choices and quality. Consumers have also had concerns as the merger may create tacit collusive behavior amongst beer makers as they may find following prices set by big companies easier than competing for market share. The new company may also make it harder for small brewers to compete.

AB inBev and SABMiller will have to appease regulators around the world as the two companies hold market shares in the US, the UK, Asia, and South America. AB inBev plans to sell UK brand Peroni and German brand Grolsch, while SABMiller may sell its 58% share of MillerCoors to Molson Coors for approximately $12 billion, while giving up global rights to the Miller name. These sacrifices may force the company to give up its market shares in China, where SABMiller holds 49% stake in a joint venture with the company that owns the best-selling beer, Snow, in China.

Comments